All Categories

Featured

Table of Contents

The are entire life insurance and global life insurance coverage. grows money value at an assured rate of interest and additionally through non-guaranteed dividends. grows cash worth at a repaired or variable price, depending on the insurance firm and policy terms. The money value is not contributed to the death benefit. Money worth is a feature you take advantage of while to life.

After 10 years, the cash worth has expanded to around $150,000. He obtains a tax-free lending of $50,000 to start an organization with his sibling. The policy financing rates of interest is 6%. He settles the finance over the next 5 years. Going this route, the rate of interest he pays returns into his policy's cash value as opposed to a banks.

Envision never ever needing to fret about small business loan or high rates of interest again. What if you could borrow money on your terms and construct wealth at the same time? That's the power of infinite financial life insurance policy. By leveraging the cash money worth of whole life insurance policy IUL plans, you can expand your wealth and obtain money without depending on typical financial institutions.

There's no collection car loan term, and you have the liberty to choose the repayment schedule, which can be as leisurely as repaying the funding at the time of fatality. This versatility expands to the servicing of the fundings, where you can choose interest-only payments, keeping the lending balance flat and manageable.

Holding money in an IUL repaired account being attributed rate of interest can frequently be much better than holding the cash on down payment at a bank.: You have actually always desired for opening your very own bakeshop. You can borrow from your IUL policy to cover the initial expenditures of renting out a space, purchasing equipment, and hiring staff.

How To Make Your Own Bank

Individual fundings can be obtained from typical financial institutions and credit rating unions. Obtaining money on a credit card is usually really expensive with annual portion prices of interest (APR) usually reaching 20% to 30% or more a year.

The tax therapy of plan loans can vary considerably relying on your country of home and the certain regards to your IUL plan. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan loans are normally tax-free, supplying a considerable benefit. However, in various other jurisdictions, there might be tax obligation effects to think about, such as prospective tax obligations on the lending.

Term life insurance policy just gives a death benefit, with no cash worth buildup. This means there's no money worth to obtain against. This article is authored by Carlton Crabbe, Chief Exec Officer of Resources for Life, a professional in supplying indexed global life insurance accounts. The information supplied in this post is for instructional and informational functions just and should not be construed as economic or financial investment guidance.

Infinite Banking 101

When you initially read about the Infinite Banking Principle (IBC), your initial response could be: This sounds also great to be real. Perhaps you're unconvinced and think Infinite Financial is a scam or plan - using life insurance as a bank. We wish to establish the document right! The issue with the Infinite Banking Idea is not the idea yet those individuals using a negative critique of Infinite Banking as a concept.

So as IBC Authorized Practitioners through the Nelson Nash Institute, we assumed we would answer some of the leading inquiries people search for online when discovering and comprehending every little thing to do with the Infinite Banking Idea. So, what is Infinite Banking? Infinite Financial was produced by Nelson Nash in 2000 and completely explained with the publication of his publication Becoming Your Own Banker: Unlock the Infinite Financial Idea.

Royal Bank Infinite Avion Rewards

You believe you are coming out monetarily ahead because you pay no passion, however you are not. When you save money for something, it normally means compromising something else and cutting down on your way of living in various other areas. You can duplicate this process, yet you are just "reducing your way to wealth." Are you pleased living with such a reductionist or shortage attitude? With conserving and paying cash, you may not pay passion, however you are using your cash as soon as; when you invest it, it's gone for life, and you surrender on the opportunity to make lifetime compound rate of interest on that particular money.

Also banks use whole life insurance policy for the very same purposes. The Canada Profits Agency (CRA) even recognizes the value of participating entire life insurance coverage as an one-of-a-kind possession class used to create lasting equity safely and naturally and supply tax obligation advantages outside the scope of conventional financial investments.

Be Your Own Bank Whole Life Insurance

It permits you to produce wide range by satisfying the financial function in your own life and the capacity to self-finance significant way of living purchases and expenses without interrupting the compound interest. Among the simplest ways to think concerning an IBC-type participating whole life insurance plan is it is similar to paying a mortgage on a home.

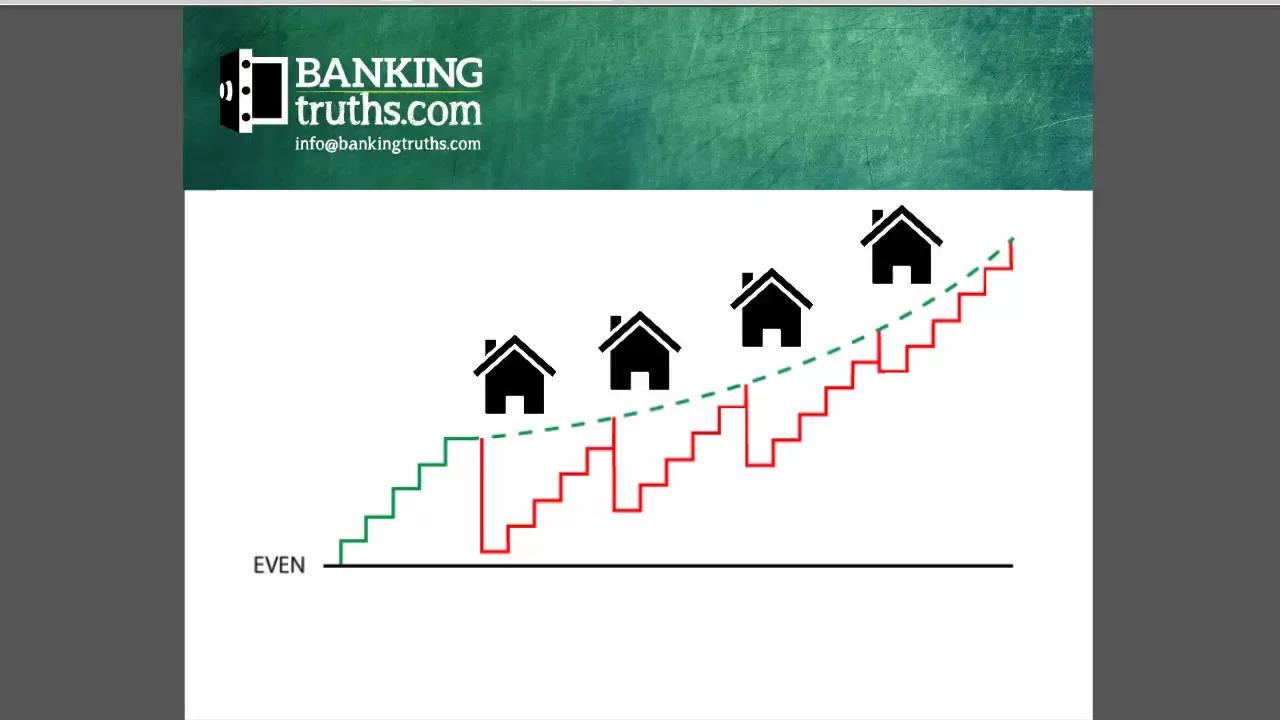

When you obtain from your taking part whole life insurance plan, the cash money worth proceeds to expand nonstop as if you never borrowed from it in the first location. This is due to the fact that you are making use of the cash value and fatality benefit as collateral for a loan from the life insurance company or as collateral from a third-party loan provider (known as collateral financing).

That's why it's critical to deal with a Licensed Life Insurance coverage Broker authorized in Infinite Financial who structures your getting involved entire life insurance coverage policy properly so you can avoid unfavorable tax obligation ramifications. Infinite Financial as an economic approach is except everyone. Here are several of the pros and cons of Infinite Banking you must seriously take into consideration in deciding whether to progress.

Our recommended insurance policy carrier, Equitable Life of Canada, a common life insurance policy company, specializes in participating entire life insurance policy plans certain to Infinite Banking. In a mutual life insurance firm, insurance policy holders are considered business co-owners and get a share of the divisible excess created yearly with returns. We have a selection of providers to pick from, such as Canada Life, Manulife and Sunlight Lifedepending on the requirements of our customers.

Please likewise download our 5 Top Questions to Ask A Limitless Financial Agent Prior To You Work with Them. For more details about Infinite Banking see: Please note: The product supplied in this newsletter is for educational and/or educational purposes just. The details, opinions and/or sights shared in this newsletter are those of the authors and not always those of the representative.

Infinite Banking Testimonials

The principle of Infinite Banking was produced by Nelson Nash in the 1980s. Nash was a financing expert and fan of the Austrian school of business economics, which promotes that the worth of products aren't explicitly the outcome of standard financial frameworks like supply and need. Rather, individuals value money and items differently based on their financial status and requirements.

One of the challenges of standard banking, according to Nash, was high-interest prices on financings. Way too many people, himself included, got involved in economic difficulty as a result of dependence on banking organizations. Long as banks set the interest rates and loan terms, individuals really did not have control over their very own wide range. Becoming your very own banker, Nash figured out, would put you in control over your monetary future.

Infinite Banking needs you to possess your monetary future. For ambitious people, it can be the finest financial tool ever before. Below are the advantages of Infinite Financial: Probably the solitary most helpful element of Infinite Financial is that it boosts your money flow.

Dividend-paying whole life insurance is really low danger and uses you, the insurance policy holder, an excellent deal of control. The control that Infinite Financial uses can best be organized into 2 categories: tax obligation advantages and property defenses.

Whole life insurance policy policies are non-correlated properties. This is why they function so well as the monetary structure of Infinite Banking. No matter what happens in the market (stock, realty, or otherwise), your insurance plan maintains its worth. A lot of people are missing this essential volatility barrier that helps shield and expand riches, rather splitting their money right into 2 pails: savings account and financial investments.

Entire life insurance coverage is that 3rd container. Not only is the rate of return on your entire life insurance policy guaranteed, your death advantage and costs are likewise guaranteed.

Whole Life Insurance Bank On Yourself

This structure lines up flawlessly with the principles of the Continuous Wealth Strategy. Infinite Banking attract those looking for better monetary control. Right here are its primary advantages: Liquidity and availability: Policy finances supply prompt accessibility to funds without the limitations of traditional small business loan. Tax performance: The cash money value expands tax-deferred, and policy car loans are tax-free, making it a tax-efficient device for constructing wealth.

Property protection: In lots of states, the cash value of life insurance policy is safeguarded from financial institutions, including an added layer of economic protection. While Infinite Banking has its merits, it isn't a one-size-fits-all remedy, and it features substantial downsides. Below's why it might not be the most effective method: Infinite Financial usually requires intricate policy structuring, which can puzzle insurance holders.

Table of Contents

Latest Posts

Bank On Yourself Insurance Companies

Being Your Own Bank

Bank On Yourself Program

More

Latest Posts

Bank On Yourself Insurance Companies

Being Your Own Bank

Bank On Yourself Program